ENTRIES TAGGED "ebook pricing"

Page count, pricing, and value propositions

Short does not equal cheap, especially when it saves me time

I was going to buy Chris Anderson’s new book but this review stopped me in my tracks:

Reads like a poorly written magazine article that has been unfortunately dragged out into a full-length book.

I’ve read far too many 300-page books that could have been summarized in 5-10 pages as a magazine article. Why do we insist on puffing up articles until they’re the length of a book? One reason is because we’re used to creating a spine presence on a physical bookshelf. That’s less of an issue these days, especially as ebooks become more popular. Another reason is that we haven’t figured out how to sell the value proposition that “shorter saves time so it’s OK to charge more for it.”

This is one area where Amazon gets it wrong sometimes. Kindle Singles don’t have to be cheap.

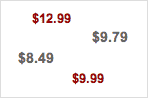

Anderson’s ebook lists for $12.99 for on bn.com. Rather than buying it and being disappointed I’d prefer paying $13.99 for a 10-page summary of the core content. Why pay more? Because it saves me time to read 10 pages vs. 300. That’s worth something to me. If publishers offered both options, $12.99 book-length and $13.99 summary, which version would sell more? Long-form will be more popular initially but short-form will eventually overtake it, especially as consumers get more comfortable with this model.

Btw, I’m not talking about those existing book summary services. I’ve tried two of them and they generally didn’t deliver, partly because they didn’t want to give away all the key elements of the book. More importantly, the summaries I tried weren’t written by the author.

Give me an ebook in summary format, written by the author, sell it at a slightly higher price and I’ll buy it. How about you?

Publishing News: Control over data is where the real war is being fought

The ebook price war is a "red herring," copyright needs the public's attention, and Wal-Mart (finally) breaks up with Amazon.

Here are a few stories that caught my attention this week in the publishing space.

Publishers, price is a distraction — focus on data control

Suw Charman-Anderson at Forbes took a look this week at Alison Flood’s report at The Guardian on the ebook price wars in the U.K., which are “prompting concerns from writers that the ‘relentless downward pressure on book prices’ could lead to industry ruin.” According to Flood’s report, authors and others in the industry are concerned that readers will get conditioned to these bargain basement prices, thus devaluing ebooks, and expect pricing at levels independent bookstores can’t afford to sustain.

Suw Charman-Anderson at Forbes took a look this week at Alison Flood’s report at The Guardian on the ebook price wars in the U.K., which are “prompting concerns from writers that the ‘relentless downward pressure on book prices’ could lead to industry ruin.” According to Flood’s report, authors and others in the industry are concerned that readers will get conditioned to these bargain basement prices, thus devaluing ebooks, and expect pricing at levels independent bookstores can’t afford to sustain.

Charman-Anderson argues that readers are smarter than that: “[t]he whole concept of sales, coupons, discounts and price wars is that the consumer gets something that’s worth more than the price paid, and they do so knowing full well that they’ve got a bargain. That’s what a bargain is.” She also argues that all these concerns over ebook price wars are a “red herring” diverting attention from the real problem. Referring to a post by Nick Harkaway at Futurebook, Charman-Anderson writes:

“Harkaway basically says that publishers need to become retailers in order to regain control over customer data, and he’s absolutely right. …. The value of customer data cannot be underestimated. Retail these days isn’t just about buying and selling; it’s about what additional value you can offer your customers based on the information you have about them.”

“The ebook price war is not the problem,” says Charman-Anderson. “The problem is that publishers have ceded the most valuable ground to the retailers.” Charman-Anderson’s piece is this week’s recommended read — you can find it here.

Publishing News: DOJ settlement, the aftermath

A look at a looming Amazon monopoly and the DOJ settlement effect on ebook pricing. Also, a chat with The Atavist CEO Evan Ratliff.

Here are a few stories from the publishing space that caught my attention this week.

Digital evolution or government-assisted monopoly?

LA Times writers Dawn C. Chmielewski and Carolyn Kellogg took a look this week at Judge Cotes’ decision to approve the proposed settlement in the ebook price fixing case and the turmoil it’s causing in the publishing industry.

LA Times writers Dawn C. Chmielewski and Carolyn Kellogg took a look this week at Judge Cotes’ decision to approve the proposed settlement in the ebook price fixing case and the turmoil it’s causing in the publishing industry.

Chmielewski and Kellogg cite a statement by the Author’s Guild “warning that the ruling would turn the clock back to 2010, when Amazon sold 90% of all e-books,” but author and publishing attorney Jonathan Kirsch warned that the decision will have much bigger picture implications:

“By putting the legal approval on this settlement, the district court has pushed us over a certain kind of cliff. In terms of the real-life experiences of publishers, authors and readers, this will represent a fundamental change in how books are published and sold … The court says we recognize that we’re in the birth pangs of a revolution of book selling, but we’re not going to torture the antitrust law into permitting one way of doing business over another way of doing business.”

Literary agent Gary Morris told Chmielewski and Kellogg that Cotes’ decision basically handed Amazon a monopoly and that publishers’ biggest fear is “that by solidifying Amazon’s indispensability as a retailer, they’ll drop wholesale prices to a level that’s unsustainable for the publishing business.” On the other hand, Forrester analyst James McQuivey said for the piece that fighting the digital evolution is folly and that “[t]he companies in a position to focus on digital distribution — which is Amazon and Barnes & Noble — those are the companies positioned to take over.”

In a related piece, LA Times writer Michael Hiltzik dug into the background of the case and the history of Amazon’s position in the ebook market, and laid out how the antitrust suit plays into Amazon’s grand plans to build a monopoly. Hiltzik argues that in pursuing the antitrust suit, “the government walked blithely past the increasing threat of an Amazon monopoly and went after the stakeholders who were trying to keep it from taking root.” And he boils down the overall takeaway from the entire situation:

“[T]he most important concern that should be shared by all participants in the publishing world — readers, publishers, retailers, device manufacturers — is that it’s in no one’s interest to have a single company controlling 90% of the market. No one, that is, except the big player, which is Amazon.”

The agency model’s impact on ebook pricing

Literary agent Simon Lipskar explains why the DOJ got it all wrong

Podcast: Play in new window | Download

The agency model has played a key role in ebook pricing models, and the DOJ’s recent ruling has generated a large number of responses from the community. One of the more interesting ones was from Simon Lipskar, President of the Writers House literary agency. I invited Lipskar to participate in a TOC podcast interview so he could talk further about his letter to the DOJ as well as where he sees the ebook market heading.

Direct sales should be a publisher priority

Bob Pritchett on how and why he built his company around a direct sales channel.

In this TOC podcast, Logos Bible Software president & CEO Bob Pritchett talks about the importance of customer engagement, building direct sales channels, and how to beat Amazon.

The state of ebook pricing

Loss leaders, the agency model and other factors shaping ebook prices.

Joe Wikert looks at the agency model, efficiencies, fixed pricing and other major trends that will drive ebook pricing in the months ahead.

Inside Look at RAND's $9.95 Ebook Pricing Strategy

Recently, the RAND Corporation announced that it has revised the suggested retail pricing on all RAND ebooks to $9.95 each. RAND ebooks are available through a wide variety of wholesale and retail partners. The press release provided some explanation for the decision, also discussed in Publishers Weekly. I have been asked by Tools of Change to provide some additional…